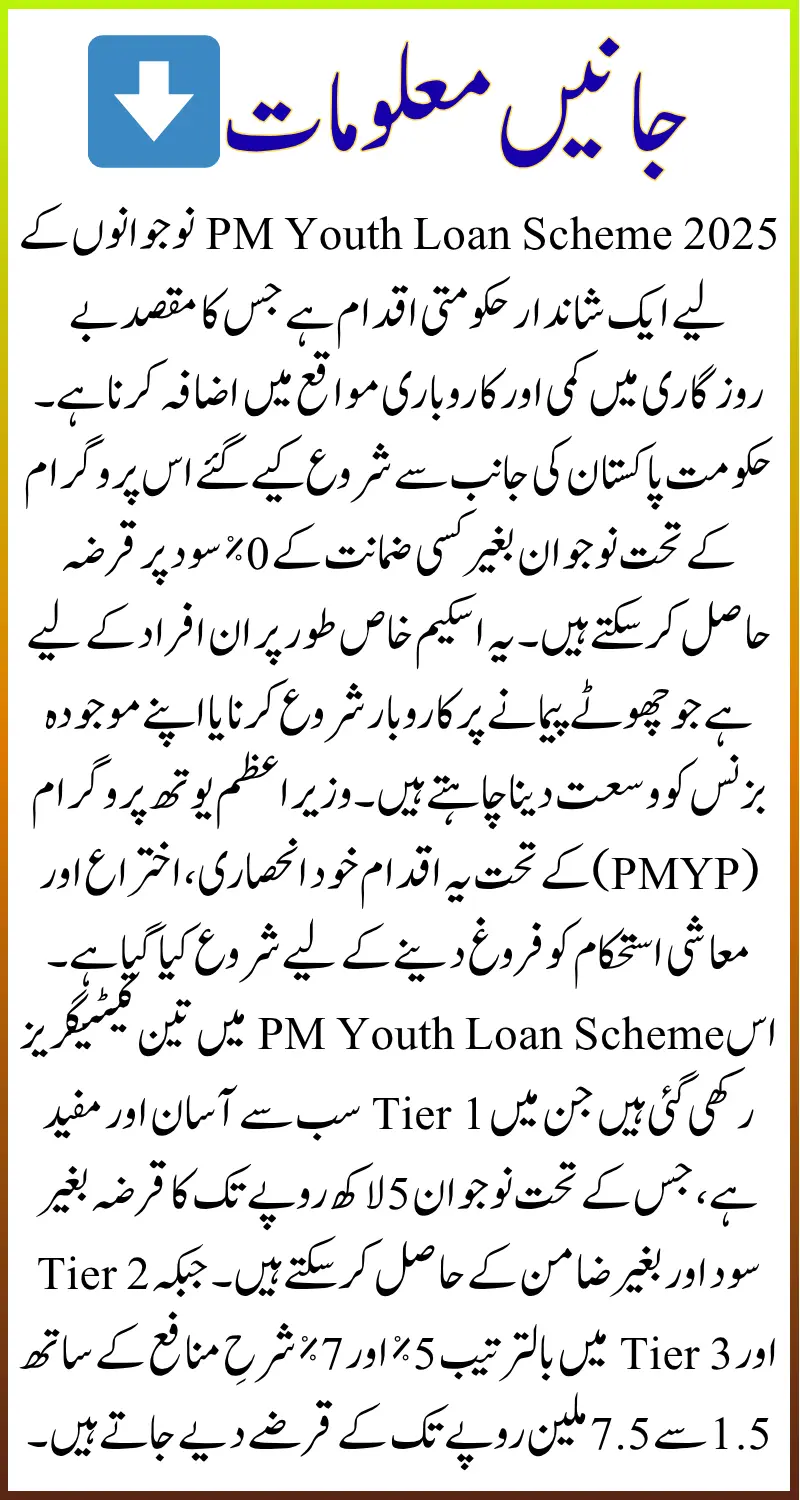

The PM Youth Loan Scheme 2025 is a remarkable step by the Government of Pakistan to empower young entrepreneurs and small business owners. With 0% interest and no guarantor requirement for small-scale loans, this program aims to promote self-employment, innovation, and economic stability among the youth.

Whether you want to start a new business, expand an existing one, or fund a digital startup, this scheme provides a gateway to financial freedom without the traditional barriers of banking.

PM Youth Loan Scheme 2025

The Prime Minister Youth Loan Scheme was launched under the Prime Minister’s Youth Program (PMYP) to provide easy financial access to Pakistan’s ambitious youth. The main goal is to reduce unemployment, encourage entrepreneurship, and promote small and medium enterprises (SMEs) across the country.

Through this scheme, applicants can receive financing between PKR 500,000 and PKR 7.5 million, depending on their business size and needs. What makes it stand out is its Tier 1 loan category offering up to PKR 500,000 at 0% interest and no guarantor, a major relief for beginners.

Also Read: PM Laptop Scheme Distribution 2025 Update: Laptops Delivery Timeline Revealed

Who Can Apply for PM Loan Scheme

Anyone passionate about starting or growing a business can apply, but certain conditions must be met:

- Age Limit: 21 to 45 years (18 years for IT and e-commerce applicants)

- Gender: Open for both men and women from all provinces, including AJK and Gilgit-Baltistan

- Education: No specific educational degree required

- Requirements: Valid CNIC and a clear business plan

This inclusivity ensures that every eligible youth, regardless of background, can benefit from the PM Youth Loan Scheme.

Loan Categories and Markup Details

The program is structured into three tiers, making it flexible and accessible for various types of businesses:

Tier 1 – Micro Businesses

- Loan Amount: Up to PKR 500,000

- Interest Rate: 0% (Interest-free)

- Guarantor: Not required

- Ideal For: Small shops, freelancers, and online startups

Tier 2 – Growing Enterprises

- Loan Amount: PKR 500,001 to PKR 1.5 million

- Interest Rate: Around 5%

- Guarantor: Basic collateral or guarantor may apply

Tier 3 – Established Businesses

- Loan Amount: Up to PKR 7.5 million

- Interest Rate: Around 7%

- Guarantor: Required for larger loans

This tier-based structure helps the government support different levels of entrepreneurship, from beginners to experienced business owners.

Also Read: BISP Double Payment October: Complete Details on Rs. 27,000 Disbursement and Eligibility Check

Documents Required for Application

To avoid delays and rejections, prepare all necessary documents before applying:

- Valid CNIC

- Recent passport-size photograph

- Active bank account details

- Proof of residence (utility bill or rent agreement)

- Comprehensive business plan

- Educational certificates (only if relevant to your business idea)

Having a strong business proposal increases your approval chances significantly.

How to Apply Online for the PM Youth Loan Scheme

The application process is fully digital and user-friendly. Here’s how to apply:

- Visit the official PM Youth Program website

- Register using your CNIC and mobile number

- Fill in personal and business details carefully

- Upload all required documents in clear format

- Review your information before final submission

- Submit your application and save your tracking ID

Applicants can later check their application status using the tracking code provided after submission.

Read More: Flood Relief Package for Flood Victims from October 17 – Survey Details Explained

Loan Review and Approval Process

Once you submit your application, it goes through a verification process conducted by designated banks such as National Bank of Pakistan (NBP), Bank of Punjab (BOP), and others.

Officials review your business plan, documents, and financial details. In some cases, you may be asked for additional clarification or an interview. Once approved, the loan is directly transferred to your bank account.

Where You Can Use the Loan

The PM Youth Loan Scheme is designed to support a wide range of business ideas and sectors, including:

- Retail shops and small businesses

- E-commerce stores and online startups

- Agriculture and livestock

- IT services, app development, and freelancing setups

- Food, clothing, and manufacturing units

The only rule is that the funds must be used for business purposes only, not for personal expenses.

Also Read: CM Punjab E-Taxi Scheme Registration Closed: Complete Guide to the Verification Phase 2025

Smart Tips to Improve Approval Chances

To increase your chances of loan approval, follow these expert suggestions:

- Write a realistic business plan with achievable goals

- Avoid exaggerated profit estimates

- Upload clear and authentic documents

- Apply early to avoid late processing delays

- Respond promptly to bank queries or requests

A well-prepared and transparent application can make your approval process much smoother.

Additional Support for Youth Entrepreneurs

The Prime Minister Youth Program (PMYP) also offers training, mentorship, and business advisory services. These initiatives help new entrepreneurs gain essential skills in management, marketing, and financial planning.

Institutions like NAVTTC, SMEDA, and State Bank of Pakistan are also collaborating to ensure transparent processing and easy access to financial literacy resources.

Also Read: CM Punjab 1100 E-Taxi Scheme 2025 – Step-by-Step Who Qualifies and Selection Details

Latest Updates for 2025 Applicants

In 2025, the government has expanded the PM Youth Loan Scheme to include more banks, digital startups, and women-led businesses. Applications are now being processed faster through online verification, and new categories like green businesses and agro-tech projects are receiving special attention.

FAQs About PM Youth Loan Scheme 2025

What is the PM Youth Loan Scheme?

It is a government initiative to provide easy business financing for youth, offering 0% interest loans up to PKR 500,000 and low-interest loans for higher amounts.

Who is eligible to apply?

Any Pakistani aged 21–45 (18+ for IT/e-commerce) with a valid CNIC and business idea can apply.

Is a guarantor required for the loan?

No, guarantors are not required for Tier 1 loans up to PKR 500,000.

How long does it take for approval?

Usually, the review process takes a few weeks, depending on document verification and business plan clarity.

Can I reapply if rejected once?

Yes, you can reapply after updating your documents or improving your business proposal.

Read More: CM Laptop Scheme Phase 2 Distribution Begins – Check Eligibility and Winner List Online

Final Summary

The PM Youth Loan Scheme 2025 is a golden opportunity for Pakistan youth to transform their business ideas into reality. With 0% interest loans, no guarantor requirements, and a simple online process, it removes the major barriers that often stop young entrepreneurs from starting their journey.

By applying with a strong business plan, realistic goals, and a clear vision, you can use this initiative as your stepping stone toward financial independence and success. The future belongs to those who take action and this scheme gives you the perfect chance to begin.